It is important for everyone to understand the basics when it comes to credit scores. Credit scores play a crucial role in your ability to secure loans, rentals, and more! In this article, our goal is to provide you with a strong understanding of credit scores so that you can set yourself up for success!

Who has a credit score? Everyone who has at least one line of credit open under their name. If you open a credit card at Target for example, after a few months of activity you will receive a credit score.

What is a credit score? It is a number from 350-800. Ultimately, it is a rating calculated based on if you make your statement payments on time or if you do not. This number helps a bank determine how likely you are to pay back the borrowed money if they were to give you a loan.

What factors go into your score?

- Paying bills on time.

- Credit usage (10-30% is ideal – If your card has a $10,000 maximum don’t spend more than $3,000).

- Amount of credit lines open.

- Age of credit lines and credit history.

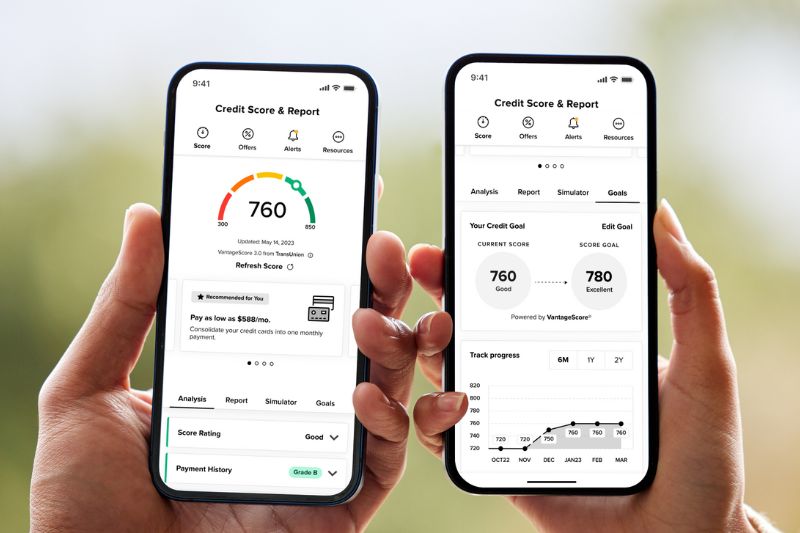

Where can you check your credit score?

- Through your bank or credit union.

- Through the credit bureau directly.

- Through your credit card’s website.

Important things to note: Checking your credit score can impact it! There are two types of credit score pulls:

- Soft Pull — usually when you personally check your credit score. Will not show up on a credit report.

- Hard Pull— usually when you are opening a new line of credit. Will show up on a credit report and may affect your score.

When is your credit score used? When you want to borrow money from the bank for a personal loan, student loan, a mortgage on your house and more.

How do you read your credit score? The higher the score the better! Below are the common ranges.

Excellent: 800-850

Very Good: 740-799

Good: 670-739

Fair: 580-669

Poor: 300-579

So why is a credit score important? Your credit score is an indicator of your financial responsibility. It can tell anyone who is going to lend you money how likely you are to pay back that loan. It is important to understand the components of a credit score, that way you can set yourself up for success!

Ready to check out your score? Try our Credit Sense tool in Online Banking. With Credit Sense you can access your credit score, full credit report, credit monitoring, financial tips and education. Plus, you can do all of this without impacting your credit score!