As fraudsters develop increasingly sophisticated scams, it’s important to stay informed about common fraud techniques and how to safeguard your personal and financial information. At Cornerstone Bank, your financial security is our top priority. Below, we highlight some of the most prevalent scams and provide tips to help you avoid becoming a victim.

Caller ID Spoofing Scams

Scammers can manipulate caller ID to make it appear as if they are calling from a trusted source, such as a bank, government agency, or well-known business. They may claim there is an urgent issue with your account and demand immediate action. For example, a scammer might pose as a representative from the IRS, calling to demand immediate payment of back taxes. They may threaten legal action or even arrest if you don’t comply.

To protect yourself, never share personal or financial information over the phone–especially if you did not initiate the call. If you receive a suspicious call, hang up and dial the organization directly using a verified number. Be cautious of any caller who creates urgency or uses fear tactics. Caller ID is easily faked, so don’t rely on it as proof of legitimacy.

Mail Fraud

Mail fraud involves criminals intercepting, stealing, or altering physical mail to gain access to personal information or checks. A common scam involves thieves stealing checks from outgoing mail, altering them, and cashing them under a different name. Another example is fraudulent letters claiming you’ve won a lottery or sweepstakes but must first send a “processing fee” to claim your winnings.

To stay safe, retrieve your mail promptly, use a locked mailbox, and shred documents with personal information before discarding them. Consider using a secure postal drop box for mailing checks, or pay bills online through Cornerstone Bank’s secure digital banking services.

Email Fraud & Phishing Scams

Phishing emails appear to come from legitimate sources and attempt to trick recipients into revealing personal or financial information. A telltale sign of scams is when the message uses urgent language like “Your account will expire soon,” “A security alert has been triggered,” or “Your account has been locked”. You might receive an email from a source claiming to be your bank, asking you to verify your account details by clicking a link. That link directs you to a fake website designed to steal your login credentials. Another variation involves an email appearing to be from a company like Amazon, alerting you to a problem with a recent order and urging you to update your payment details.

To stay safe, always verify the sender’s email address before responding. Check for misspellings, extra punctuation, or domain names that don’t match the official website (e.g., support@amaz0n.co instead of support@amazon.com). Hover your mouse over links without clicking to see the actual URL—if it looks suspicious or unfamiliar, don’t click it. Avoid opening attachments or downloading files from unknown senders.

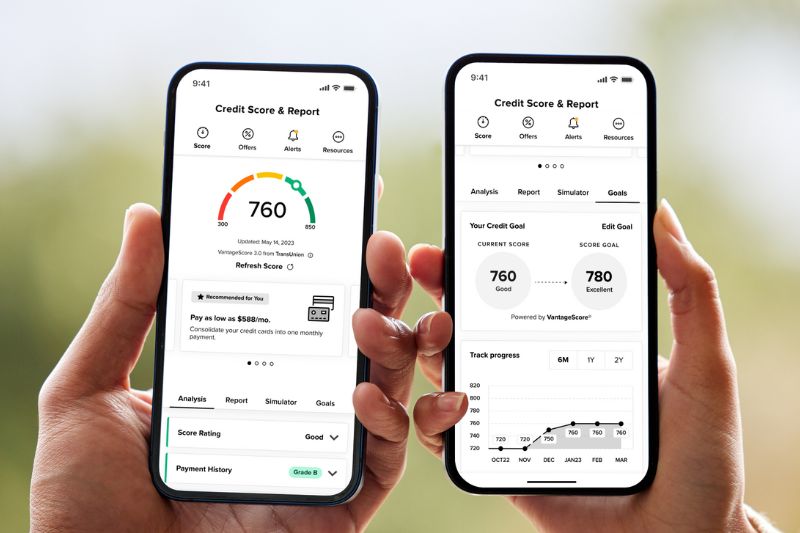

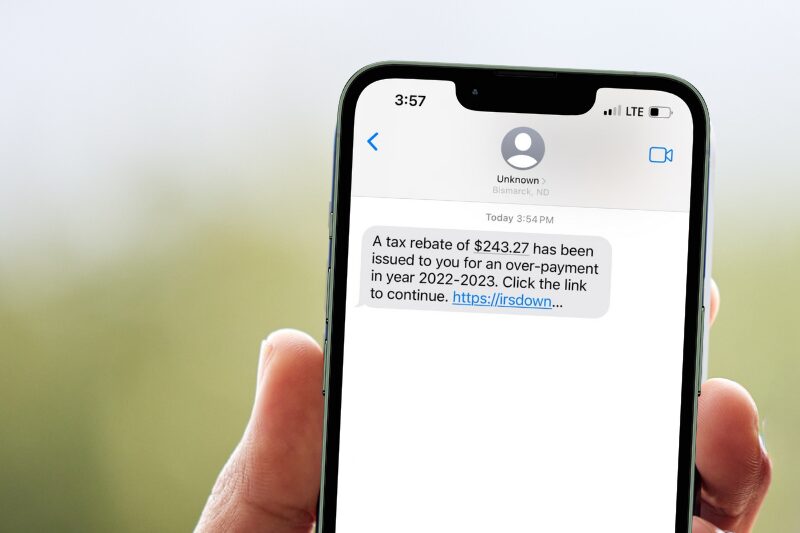

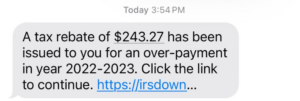

Text Phishing (Smishing)

Smishing is a type of scam that involves fraudulent text messages that impersonate banks, delivery services, or government agencies. A common example is receiving a text message claiming your bank account has been locked and instructing you to click a link to verify your identity. Once you do, scammers can steal your login information. Another scenario involves receiving a text about an undelivered package, prompting you to enter your credit card details to “reschedule” delivery.

To avoid falling victim, don’t respond to texts from unknown numbers, and avoid clicking on unfamiliar links. If a text claims to be from Cornerstone Bank or any financial institution, call the number listed on your bank card or the official website to confirm. Enable spam filters on your phone when available, and report scam texts to your carrier.

Check Overpayment Scams

These scams often target individuals selling items online. A scammer might send a check for more than the agreed amount and ask you to refund the excess via wire transfer or gift cards. For instance, a seller might list a used laptop for sale, and the buyer sends a check for $2,000 instead of the agreed $500, then ask for $1,500 back. Later, the bank discovers the check was fraudulent, leaving you without both the payment and the money you refunded.

To avoid being scammed, never accept a check for more than the agreed amount. If someone insists on overpaying, it’s a red flag. Wait for checks to fully clear—which can take several business days—before spending or transferring any funds. Use secure payment platforms when possible.

Job Opportunity Scams

With these types of scams, fraudsters post fake job listings or send unsolicited job offers that require victims to provide personal information, make upfront payments, or deposit fraudulent checks. Commonly, the victim receives an email offering a remote position with an excellent salary but requiring you to make a purchase upfront (such a work equipment, training materials, or something similar). Another variation includes a “mystery shopper” position where the victim receives an advance (via check) to evaluate a retailer—only to find out the check was fake after you’ve wired the money back.

To stay safe, verify job listings through trusted websites or directly with the company’s HR department. Be skeptical of job offers that arrive out of the blue, and especially of those promising high pay for little effort. Never provide personal or financial information without confirming an employer’s legitimacy.

Online Dating & Catfish Scams

Romance scams prey on people looking for companionship. Fraudsters create fake profiles on dating sites or on social media and build relationships with their targets. Eventually, they invent a reason to ask for money—such as an emergency, medical bill, or even a plane ticket to visit you. In one case, a person developed an online relationship with someone claiming to be overseas for work, only to be repeatedly asked for money to cover “unexpected expenses.”

Avoid sending money or gifts to people you’ve never met in person, no matter how close you feel to them. Be wary if someone avoids video calls or always has an excuse for not meeting. Reverse-search their profile photos using a tool like images.google.com to see if they appear on scam alert websites.

Fake Charity Scams

Scammers can sometimes pose as charities seeking donations, especially after natural disasters or crises. They might call or email, using high-pressure tactics to make you donate immediately. A victim might receive an urgent phone call claiming to be from a disaster relief organization, requesting credit card details for an emergency fund. Legitimate charities don’t pressure you into donating on the spot.

Always research the organization by visiting their official website and verifying the charity’s legitimacy through trusted sources like Charity Navigator, Candid’s Guidestar, or the Better Business Bureau. Look for red flags like vague mission statements, lack of contact information, or newly registered websites. Use reputable payment processing platforms to securely process donations.

Social Media Marketplace Scams

Scammers post fake ads for products or rental properties at unbeatable prices, requiring payment upfront. After payment, the seller disappears. One common scam involves a fraudulent vacation rental listing—when the traveler arrives, they find out the property was never available.

Start by checking the seller’s profile. Inconsistencies, errors, lack of information, a recently created profile, and negative or bad reviews from others are all red flags. Always meet sellers in safe, public locations and avoid making upfront payments for goods or rentals. Never pay for goods or services through non-traceable methods like gift cards, cryptocurrency, or wire transfers. If a deal seems too good to be true, it probably is.

Tech Support Scams

The victim might receive a pop-up message or phone call claiming their computer has been infected with a virus. The scammer, pretending to be from Microsoft or Apple, instructs them to grant remote access to the computer or pay for fake security software. A victim who follows their instructions may end up having sensitive data stolen or their computer locked for ransom.

To avoid falling victim, ignore unsolicited pop-ups or tech support calls. Legitimate tech companies do not contact users directly about issues. If you receive a suspicious message, close the browser and restart your device. Keep your antivirus software updated and use official channels for technical support.

Utility Scam Calls

Scammers impersonate utility companies, claiming you have an overdue bill and threatening to shut off your service unless you make an immediate payment. A common example involves someone posing as a power company representative calling to demand immediate payment via prepaid debit card or cryptocurrency.

If you receive such a call, don’t panic. Contact your utility company directly using the number on your latest bill or their official website. Don’t give out account numbers or payment information over the phone unless you initiated the call.

Grandparent Scams

Scammers target elderly individuals by posing as a grandchild in distress, claiming they need immediate financial assistance for an emergency, such as bail money or medical bills. They may even use AI voice cloning technology to mimic the grandchild’s voice. A grandmother might receive a call from someone claiming to be her grandson, urgently asking for money to get out of a foreign jail.

If you receive such a call, ask personal questions only your real grandchild would know, and never wire money or provide financial details over the phone. Always confirm the story by contacting another trusted family member.

Avoid Scams By Taking Control of Your Online Information

At Cornerstone Bank, we’re committed to keeping our customers informed and protected against fraud. If you ever suspect fraudulent activity on your account or receive a suspicious request, contact us immediately.

For more financial security tips and resources, visit our website or stop by your nearest Cornerstone Bank branch. We’re here to help you stay one step ahead of scammers.